What does the success of semiconductors mean for investment, markets, and industrial policy?

The MSc programmes of the School of Finance and Management at SOAS University of London pay increased attention to the global and international issues arising from emerging technologies – from the blockchain and cryptocurrencies to genome editing – and to their implications for business, finance, and government. Few technologies are as crucial in today’s world as semiconductors. Semiconductors are materials that can conduct electricity under certain circumstances and insulate under others. They are an essential component of modern electronics, used in everything from computer chips to solar panels.

The history of the semiconductor industry has been brilliantly traced in the recent book Chip War: The Fight for the World's Most Critical Technology by Chris Miller, which was awarded the 2022 Financial Times Book of the Year. The book traces the development of the technology, of the companies, and of the individuals behind the rise and success of semiconductors. The book also sheds some light on contemporary issues of international trade, economic growth, and geopolitical affairs, like the concentration of frontier technologies in the hands of a few companies, the reconfiguration of international supply chains, and the relocation of fabrication plants (or ‘fabs’).

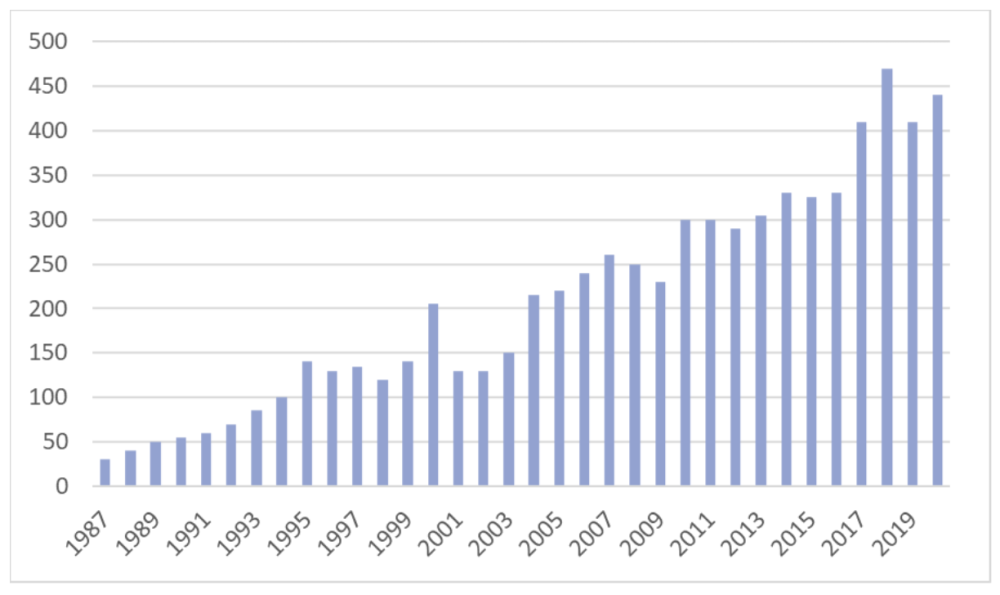

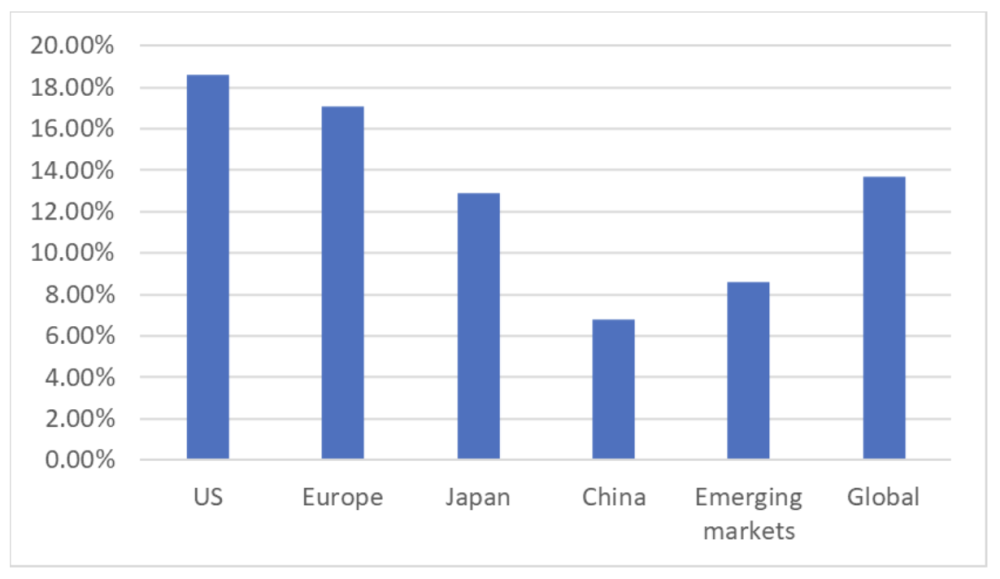

While Chip War is highly informative, it is relatively short in providing figures that help appraise the scale of the semiconductor firms, industry, and trade. This post aims to partially fill out this gap by reviewing some of the latest data on the semiconductor industry. As Figure 1 shows, the semiconductor business has been consistently growing over the last decades. The main exporters of semiconductors are China, Taiwan, South Korea, and Japan, with minor international market shares in the US, Europe, and other countries, especially in Asia. Production of semiconductors, however, is not fully indicative of the control over technology and of the appropriation of value. As Figure 2 shows, the most advanced R&D on semiconductors takes place in a few countries, namely, the US, Europe, and Japan, and specifically in not so many relatively large players in the industry. By sales revenue, the largest industry players are shown in Table 1. By market capitalisation, they are indicated in Table 2.

|

Rank |

Company |

Location |

Total sales revenue (US$bn 2020) |

Net profit (US$bn 2020) |

|

1 |

Samsung |

South Korea |

200.9 |

22.1 |

|

2 |

Intel |

US |

77.9 |

20.9 |

|

3 |

Taiwan Semiconductor (TSMC) |

Taiwan |

45.5 |

17.6 |

|

4 |

SK Hynix |

South Korea |

27.1 |

4.0 |

|

5 |

Qualcomm |

US |

21.7 |

5.2 |

|

6 |

Micron |

US |

21.4 |

2.7 |

|

7 |

NVIDIA |

US |

16.7 |

4.3 |

|

8 |

ASML Holding |

The Netherlands |

15.9 |

4.2 |

|

9 |

Texas Instruments |

US |

14.5 |

5.6 |

|

10 |

MediaTek |

Taiwan |

10.9 |

1.4 |

Table 1. Top 10 semiconductor companies by total sales revenue (source: Global Data Intelligence Centre)

|

Rank |

Company |

Location |

Market capitalisation (US$bn 2020) |

|

1 |

Taiwan Semiconductor (TSMC) |

Taiwan |

380.28 |

|

2 |

NVIDIA |

US |

349.77 |

|

3 |

Samsung |

South Korea |

292.59 |

|

4 |

Broadcom |

US |

227.70 |

|

5 |

ASML Holding |

The Netherlands |

218.87 |

|

6 |

Texas Instruments |

US |

146.29 |

|

7 |

Qualcomm |

US |

119.91 |

|

8 |

Intel |

US |

105.40 |

|

9 |

AMD |

US |

100.88 |

|

10 |

Analog Devices |

US |

81.62 |

Table 2. Top 10 semiconductor companies by market capitalisation (source: Companiesmarketcap.com, accessed on 28th December 2022)

Companies in the semiconductor industry play different roles depending on their position in the global semiconductor value system (Bown, 2020). The semiconductor industry builds, first, on the firms that produce semiconductor manufacturing equipment (such as ASLM), those that produce specialised chemicals and materials, and those that produce the software tools for designing integrated circuits. Part of the industry, then, consists of companies that design and manufacture their chips (integrated device manufacturers), like, for example, Intel, Micron, Texas Instruments, Samsung, and SK Hynix. Another part of the industry, instead, consists of companies that design semiconductors, like, for example, Broadcom, Qualcomm, and NVIDIA, and of companies that manufacture semiconductors, like, for example, Taiwan Semiconductors (TSMC), GlobalFoundries (based in the US), and SMIC (based in China). The final segments of the industry consist of companies that do the assemblage, testing, and packaging of chips and of those that eventually use chips in final components or consumer products.

The governments of several countries in the world are turning their attention to the semiconductor industries, with the intent of strengthening scientific research, technological development, and industrial position of national companies – like, for example, US’ Creating Helpful Incentives to Produce Semiconductors and Science Act (CHIPS Act), signed into law on 9th August 2022. Semiconductors are likely to play a central role in public policies that aim to stimulate research, the competitiveness of national firms, and successful international trade in the years to come.

About the author

Dr Alberto Asquer is the Director of Public Policy & Management and Public Financial Management programmes for the Centre for Financial and Management Studies and a Senior Lecturer in Public Policy and Management at the School of Finance and Management.