Microfinance and financial inclusion: Lessons from South Asia

Key information

- Date

- Time

-

5:00 pm to 6:30 pm

- Venue

- Paul Webley Wing, Senate House - SOAS University of London

- Room

- S312

- Event type

- Seminar

About this event

Over the last decade, the financial sector has been deeply affected by digitisation, automation, and the green transition.

South Asia, including Bangladesh, has been no exception. Innovative inclusive digital financial services have been significantly impacting the bottom of the pyramid in South Asia. Microfinance institutions (MFIs) have emerged as ‘agents of change’.

This seminar focuses on the developmental role that the Central Bank of Bangladesh has strategically played in expanding the microfinance outreach in Bangladesh. It analyses how the central bank fostered a well-crafted regulatory landscape and provided a bridge to the MFIs in accessing wholesale credit from commercial banks, and in some instances also from the central bank. This was very crucial for allowing MFIs to positively affect savings, investment and human development of the earlier financially unserved and underserved communities in Bangladesh.

The seminar also covers the role of digitisation as a driver of socio-economic changes from below and outlines key replicable lessons from this experience of financial inclusion in Bangladesh for other countries in South Asia and across the world.

Header Image credit: Al Ishrak Sunny via Unsplash.

About the speaker

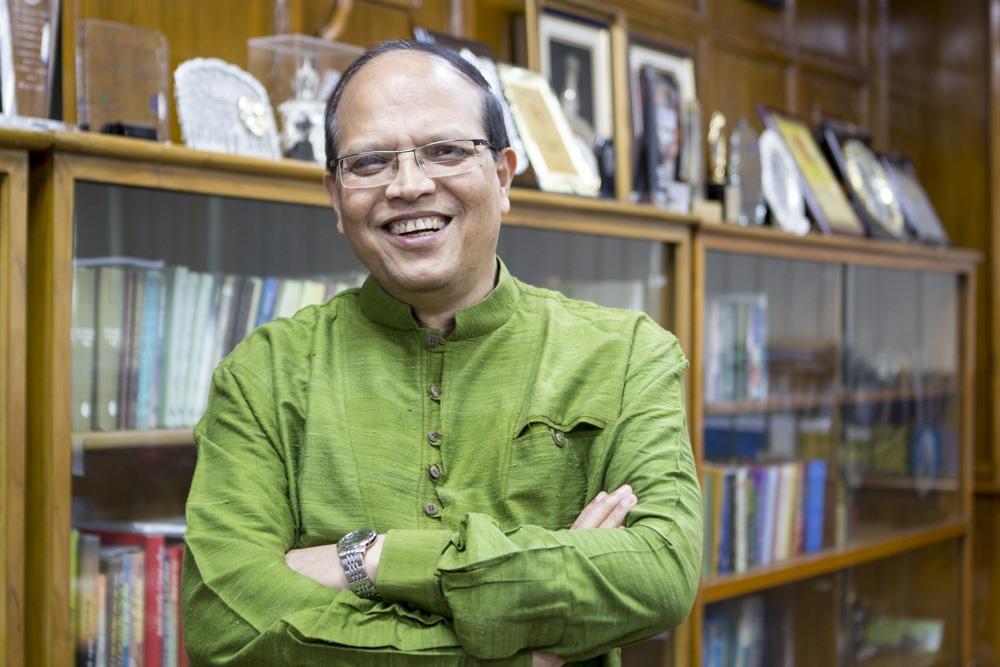

Dr. Atiur Rahman is currently an Emeritus Professor at the Department of Development Studies, University of Dhaka, and Chair of the Executive Committee of the Center for Advanced Research in Arts and Social Sciences (CARASS), University of Dhaka. He is also the chairman of the Academic Advisers to UCSI, Bangladesh campus.

Dr. Atiur Rahman served as the 10th Governor of the Central Bank of Bangladesh from 2009 to 2016. During his leadership, he became renowned for his innovative policies promoting financial inclusion, ethical banking, and sustainable development. He enhanced access to finance for marginalised groups, including farmers, small entrepreneurs, and women. As Chairman of the Microcredit Regulatory Authority (MRA), he regulated and developed the microfinance sector, helping to build a more inclusive financial system.

Known as the "Green Governor," Dr. Atiur Rahman was a pioneer in promoting climate-friendly sustainable finance. He actively advocated for green banking practices, encouraging banks to adopt eco-friendly policies and develop financial products that support environmentally sustainable initiatives. Under his leadership, the Bank promoted investments in renewable energy projects, green bonds, and low-carbon businesses, establishing Bangladesh as a leader in global climate finance.

Dr. Rahman was recently awarded an honorary Doctor of Science (DSc) in Economics by SOAS University of London as a recognition of his lifelong research on poverty reduction, his regulatory performance as Governor of the Central Bank of Bangladesh, and his commitment to financial inclusion and climate-friendly sustainable finance.

Dr. Rahman has published over 100 books in both English and Bengali. His writings focus on various subjects, including the lives and works of prominent Bengali figures such as Bangabandhu Sheikh Mujibur Rahman and Rabindranath Tagore. He has also published numerous papers in national and international journals.